CheckLogic: A Check Processing Suite

eDOCMobile

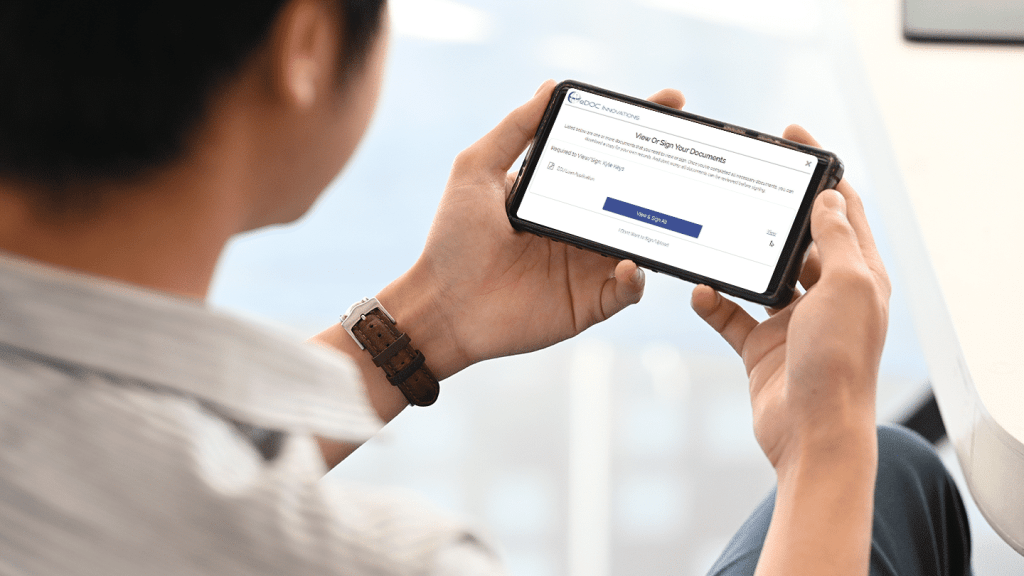

With eDOCMobile RDC, credit union members can deposit checks from anywhere via their Apple or Android smartphone. Once the transaction is successfully completed, members receive a status of their transaction via their smartphone. Business rules allow the credit union to determine critical risk assessment parameters. To combat fraud, all transactions are transmitted with multi-layer security that can be traced back to the registered smartphone for deposit time and location.

Manager

With our Check Manager solution, all share draft processing is completed via a centralized online system. Posting files can be downloaded into your core system manually or the system can automatically download the file to the folder destination of your choice. Return files created by your core system can be uploaded to the system, manually or automatically to monitor a specified folder, to create your return file to the Federal Reserve Bank. Check images are accessed quickly via an online portal and deposit information can be linked to e-statements and home banking services for 24/7 member access.

Branch

Deposit checks quickly and securely from any credit union location with our Branch Checking solution. All checks are converted to secure X9.37 files for electronic forward processing and clearing.

CheckLogic Biz

CheckLogic Biz is an intuitive interface that makes check scanning simple. With the software, merchants can scan and deposit items, and view previously deposited items. Merchants can also deposit in batches by selecting their desired account and deposit multiple items in a single batch. So, say goodbye to those tedious end-of-day trips to your credit union.

Our CheckLogic Biz solution enables Merchant Members to make deposits from their business by scanning checks from a Canon scanner and using eDOC’s advanced capture, electronic image forward processing software. The solution provides a “near-real-time” posting of approved deposits to the merchant account. Detailed deposit reports also are available to members via a web portal.

Positive Pay

Mitigate check fraud for your business members with positive pay. When members create checks, they upload a list to the Positive Pay system either manually or via a CSV file. The Positive Pay system verifies the check information against what is uploaded in the system. Matching checks are approved, while mismatches are sent for review.